- #HOW DO YOU GET DATA ANALYSIS ON EXCEL FOR A MAC HOW TO#

- #HOW DO YOU GET DATA ANALYSIS ON EXCEL FOR A MAC FOR MAC#

- #HOW DO YOU GET DATA ANALYSIS ON EXCEL FOR A MAC INSTALL#

- #HOW DO YOU GET DATA ANALYSIS ON EXCEL FOR A MAC DOWNLOAD#

The Analysis Toolpak is an Excel add-in program that is available when you install Microsoft Office or Excel (See later for.Ī PC and Mac.

#HOW DO YOU GET DATA ANALYSIS ON EXCEL FOR A MAC FOR MAC#

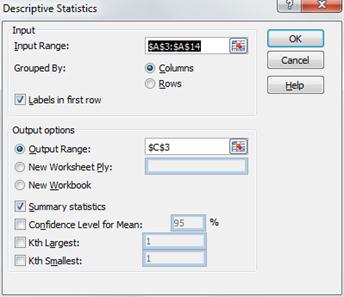

Install Solver Add-in in Office / Excel Open Excel for Mac Go. You do not need to install and run the 3rd Party Solver or Data Analysis add-in. 3) Confirm these loaded by going to the Data tab. 1) From the Top Nav go to Tools > Excel Add-ins 2) Select Analysis ToolPak and Solver Add-in. Once the add in has been successfully installed you will see data analysis when you click on the data tab (usually to the far right of the toolbar).

#HOW DO YOU GET DATA ANALYSIS ON EXCEL FOR A MAC HOW TO#

How to Add Analysis ToolPak in Excel for Mac? Reason being you need to have this open along with your Excel file in order to run the statistical analysis covered in class and having the shortcut there will. To confirm whether you already have the Analysis Toolpak installed, open the Data tab (red arrow) on the. The Analysis Toolpak is an Excel add-in program that is available when you install Microsoft Office or Excel (See later for.

All other values are given by this equation, where the time period is 9. The first value is simply a 9-day trailing average. The MACD is simply the 12 day EMA minus the 26 day EMA. The screengrab below illustrates what the spreadsheet should look like, and how the formulas are entered.Īgain, the first value is simply an average of the last 26 day’s closing prices, with all other values given by the above formula (with the Time Period equal to 26) Essentially, today’s EMA is a function of today’s closing price and yesterday’s EMA. Where Time Period is 12, n refers to today, and n-1 refers to yesterday. All other values are given by this formula.

The first value is simply a trailing 12-day average, calculated with Excel’s =AVERAGE() function. You can get historical stock quotes using this bulk stock data downloader spreadsheet.įor the worked example below, we use daily close prices for Apple (ticker: AAPL) from 19 th Feb 2013 to 22 nd May 2013 dates are in Column A and prices in Column C. Step 1: Get historical daily close prices

#HOW DO YOU GET DATA ANALYSIS ON EXCEL FOR A MAC DOWNLOAD#

You can download the complete spreadsheet at the bottom of this article. In the following step-by-step guide, we’ll calculate the MACD of Apple, giving you all the tools you need to recreate the chart above. Other nuances will be explored in the next article in this series.ĭeveloped by Gerald Appel in the 1970s, MACD is now widely used by traders to generate forecast price trends, and generate buy and sell signals. when the histogram goes from positive negative). A sell signal, however, is generated when a falling MACD crosses over the signal line (i.e. when the histogram goes from negative to positive). The chart below, for example, is the MACD and signal line for Apple between two dates.Ī buy signal is generated when a rising MACD crosses over the the signal line (i.e. The third is simply the MCAD minus the signal, and is known as the histogram. The second is the EMA of the difference this is the signal line. The first is the difference between the 12-day and 26-day exponential moving average (EMA) of the closing price this is the MACD line. The second part explores how market technicians use MACD to make better trading decisions.Īn MACD chart consists of three elements. This part offers a step-by-step guide to calculating and charting MACD in Excel. This article is the first of a two-part series. The Moving Average Convergence Divergence (or MACD) indicator is a powerful momentum-based trading indicator. Learn how to calculate and plot MACD in Excel, and start making better trading decisions.

0 kommentar(er)

0 kommentar(er)